Delta Dunia Group is an Indonesian based holding company with a diverse business portfolio. We stand at the forefront of innovation and excellence in the mining industry, offering comprehensive coal mining services in Indonesia and Australia. Our global footprint began growing in 2021 when we entered the Australian market. In 2023, we took another leap forward by establishing PT Bukit Teknologi Digital (BTech), focused on delivering end-to-end mining technology solutions, and PT BISA Ruang Nuswantara (BIRU), to lead our community empowerment efforts through social, educational, and environmental initiatives.

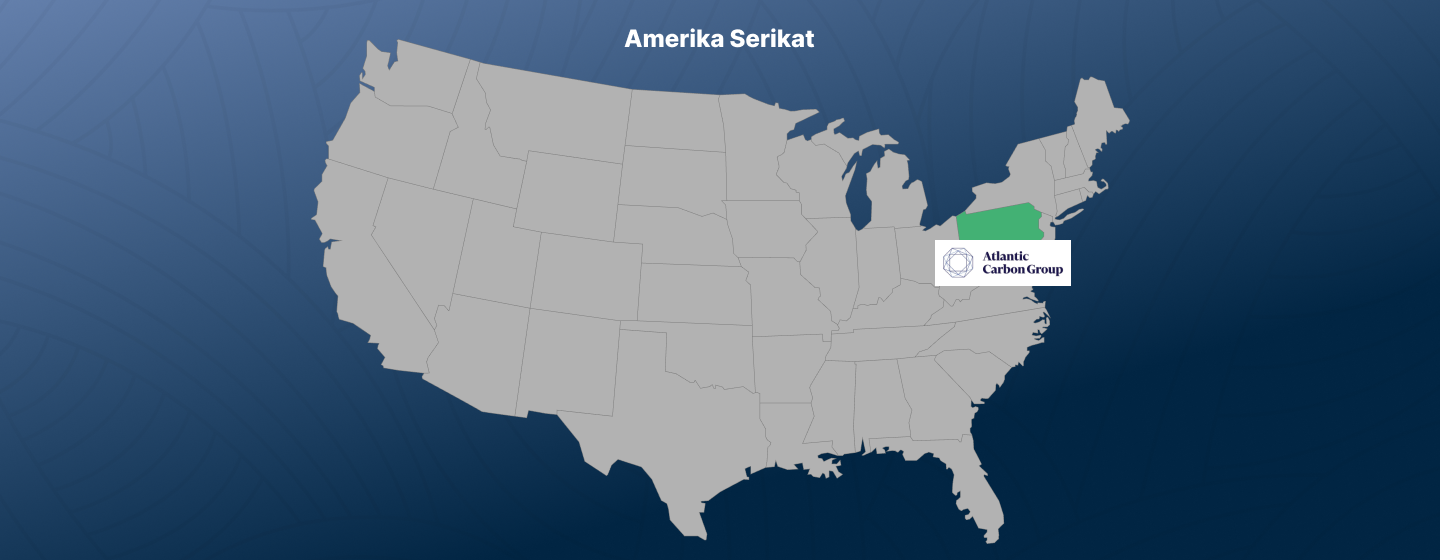

In June 2024, we expanded our businesses into mine ownership through the strategic acquisition of Atlantic Carbon Group, Inc. (ACG), a leading US producer of ultra high-grade anthracite coal. This acquisition marks a significant milestone, enhancing our capabilities and solidifying our position in the global mining market.

Our expertise extends beyond traditional mining; we empower the broader mining sector with cutting-edge technologies and initiate social programs that champion education and entrepreneurial development. Our commitment is not only to extract value from the earth but also to invest in the communities and environments we touch.

Our foundation is strong, anchored in enduring partnerships and a dedication to responsible mining, creating job opportunities, and enhancing community well-being. This dedication has solidified our role as a trusted corporate citizen, devoted to delivering lasting value and nurturing sustainable environments.

Guided by visionary leadership and robust financial principles, we are focused on enriching stakeholder value and transitioning towards a low-carbon economy. We are firmly committed to reducing our thermal coal reliance, paving the way for a sustainable energy future through collaborative innovation. Our team, the driving force behind our success, exemplifies resilience and excellence, fueling our ambitions for sustainable growth.

Our investments today are to make tomorrow possible. We continuously pave the way in sustainable technology, mineral exploration, and renewable energy solutions, preparing for a future where our legacy resonates with the aspirations of a greener, more sustainable world.

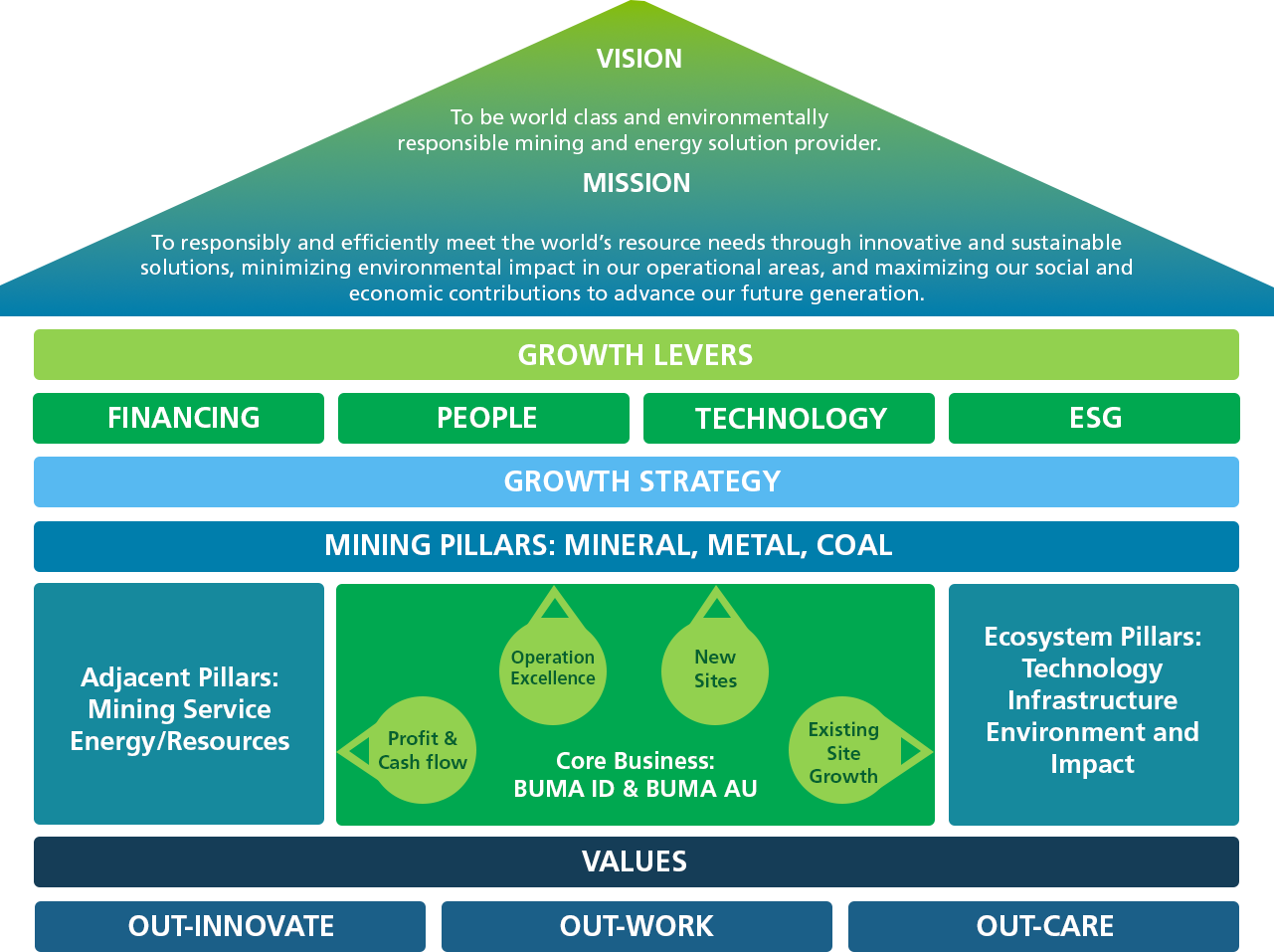

To become a world-class and environmentally responsible mining and energy solution provider.

We conduct our business by adhering firmly to the values of integrity, honesty, trust, and accountability.

We conduct our business by adhering firmly to the values of integrity, honesty, trust, and accountability.

The Company prioritizes top-quality service with the highest professional standards through continuous evaluation, improvement, and learning in every business activity.

We value its stakeholders by acting responsively and carefully in every business activity.

Courage and personal integrity guide us in leading towards our vision of becoming a leader in the mining services industry. We strive to inspire and motivate those around us to progress together.

We adhere to the principle of mutual cooperation and consistently engages in intensive open communication, sharing knowledge and skills to achieve our vision and mission in a competitive environment.

Delta Dunia Group’s business strategy is designed to navigate the global energy transition while accelerating ESG practices and seizing opportunities beyond coal. The roadmap is anchored in three key pillars: organic growth, which enhances operational excellence and profitability through expansion and innovation; diversification, focusing on investments in metals, minerals, and strategic acquisitions to strengthen revenue streams; and a strong commitment to ESG leadership, aligning with global sustainability goals to future-proof the business and capitalize on alternatives to coal.